California Tax Resolution Success Story

Even though our offices are in Fort Smith, Arkansas, we help clients throughout the United States. Recently, we helped a client in California named Chelsea.

Chelsea owes the IRS a little over $8,000. She works for the government and had an automated 15% levy on her wages. With our expert tax resolution help, the IRS agreed to release the levy and put her case into non-collectable status. This means she will be making zero monthly payments.

Another happy client!

If you owe the IRS, we recommend you give us a call at (855)-447-7332. We offer a free initial consultation to review your tax problems, and provide you with the best possible options. Helping individuals get tax relief is what we do.

IRS Scammers: Example of a Fake IRS Notice

There has been a lot of news about tax scams lately. These are scammers who pretend to be the IRS and call innocent individuals demanding immediate payment of their tax debt. Some even send fake IRS notices, telling people to call them as soon as possible.

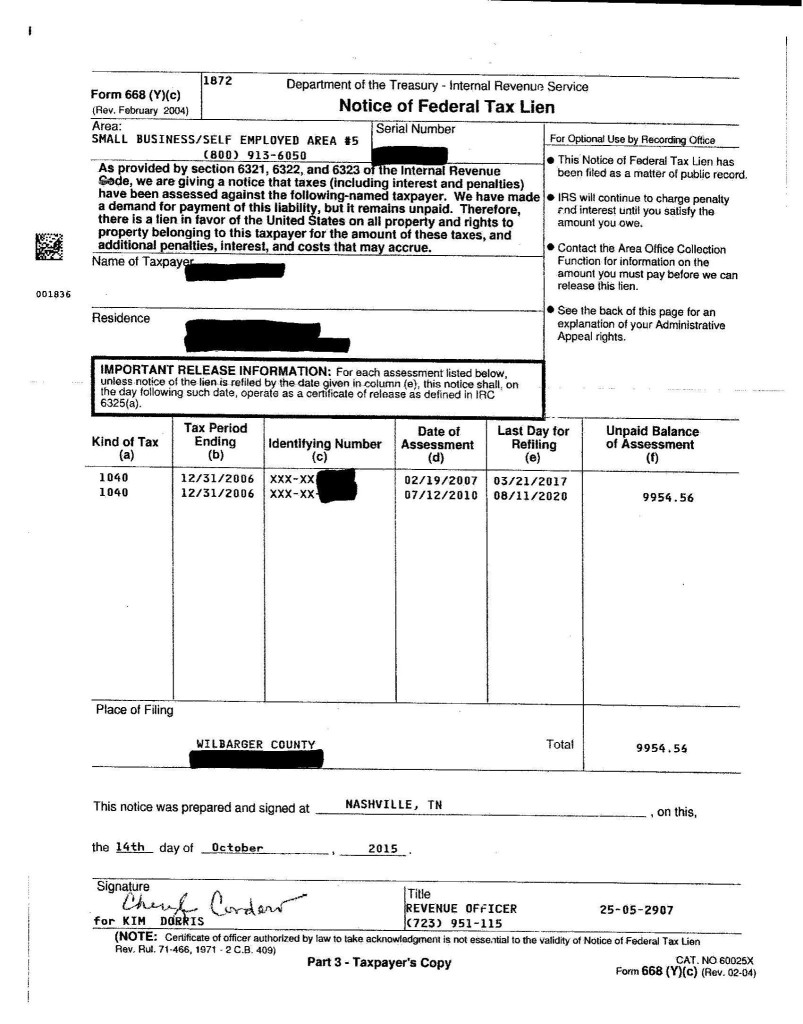

Here is a scan of an actual Notice of Federal Tax lien from the IRS:

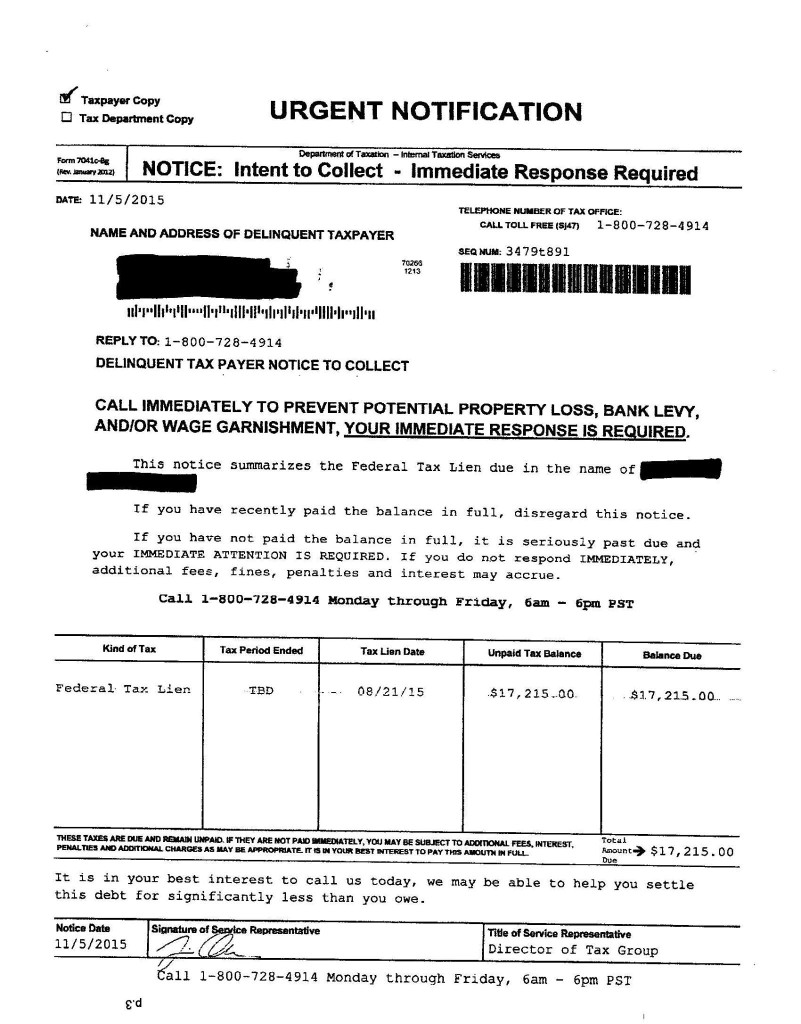

And here’s a notice sent by a company that attempts to fool the taxpayer into believing it is coming from the IRS and they BETTER CALL NOW:

If these innocent people call they don't get the IRS, they get the hard sell from a company trying to scare them. So shameful and upsetting.

It’s important to know the IRS will never:

- Threaten you to call police or have you arrested.

- Ask for a debit/credit card number over the phone.

- Make you pay by specific methods – such as a prepaid debit card.

- Call and demand payment immediately.

- Call about your tax debt without having sent you an IRS notice first.

If you think you’ve been contacted by a scammer pretending to be the IRS, you can call TIGTA at 1.800.366.4484. TIGTA, which stands for the Treasury Inspector General for Tax Administration, can help investigate the case.

If you think you do owe taxes, but are not sure how much or need help, give us a call. We can contact the IRS on your behalf, find out how much you owe, and negotiate a deal to help lower your tax debt. We are tax resolution professionals dedicated to bringing tax relief all across the United States.

IRS Revenue Officer Indicted For Fraud

As you may know, I am a former IRS Revenue Officer. As a Revenue Officer, I was not allowed to offer any financial services for fees, including preparing tax returns. This was very frustrating because I was one of a very small handful of Revenue Officers that was also a CPA and not being able to make money on the side using my education drove me crazy. They would be fine with me being a greeter at Walmart, but I couldn't prepare returns. This is one of the major reasons I left the service to "go to the dark side" as they say and represent taxpayers against the IRS. It has been rewarding beyond my expectations so far. I really appreciate my clients and I love the rewarding feeling I get when I solve their IRS problems. This allows them to sleep better at night and reassures me that I made the right decision.

In working with the IRS on this side of the table, I have worked with several Revenue Officers on behalf of my clients. One thing I have learned is that not all RO groups operate the way mine did. Some of them don't follow the rules, and others are just downright mean. That never happened to my knowledge in Fort Smith. Nothing feels better than running into one of these rogue RO's and winning a case against them because they either don't know their jobs the way they should or just don't follow the rules. There is no excuse for public servants violating tax laws or being hostile toward taxpayers. Below I am sharing an article written by Michael Cohn about a rogue RO that is accused of several crimes and if convicted will likely spend quite some time in Federal Prison as he should. All credit for this article belongs to Mr. Cohn, and not me.

NEW YORK (MAY 1, 2015)

BY MICHAEL COHN

An Internal Revenue Service revenue officer has been indicted for committing mail and wire fraud, filing false tax returns, identity theft and perjury.

James Brewer, a 38-year-old Staten Island, N.Y., resident who works in the IRS's Edison, N.J., office, was charged in the U.S. District Court for the Eastern District of New York in a 28-count indictment that was unsealed Thursday. The charges include seven counts of wire fraud, mail fraud, three counts of subscribing to false federal tax returns, six counts of aiding and assisting in the preparation of false federal tax returns, ten counts of aggravated identity theft, and perjury. Brewer was assigned to an IRS office in Edison, N.J. He was arrested in Las Vegas and is expected to be arraigned Friday afternoon.

According to the indictment, Brewer operated two outside businesses, contrary to IRS regulations. He prepared tax returns for others in exchange for fees, and he operated a business selling designer clothes, collectable toys, sports memorabilia, and other items on eBay. As part of a scheme to fraudulently reduce his taxable income and increase his tax refunds, Brewer allegedly failed to report any income he received for his unauthorized tax prep business. He also underreported the gross receipts earned from his Internet retail business, and claimed false dependents on federal tax returns he prepared and filed on his own behalf for three tax years.

Brewer also allegedly engaged in a multi-year scheme in which he prepared and filed false tax returns for others. In that business, Brewer listed false dependents and false deductions to fraudulently cause his clients to receive a refund to which they were otherwise not entitled or fraudulently inflate their refunds.

In doing so, Brewer listed the names and Social Security numbers of various people on the tax returns as dependents without their authorization. As part of this scheme, Brewer also diverted a portion of those clients' refunds to himself, in some cases without his clients' authorization or knowledge. Finally, in an effort to fraudulently obtain for himself a tax credit for first time homebuyers, Brewer lied under oath about his residency when he testified in a matter in the U.S. Tax Court in New York, New York.

"The crimes alleged in this indictment are very serious. While employed by the IRS to enforce our nation's tax laws, it is alleged that James Brewer was himself breaking these laws," said Jonathan D. Larsen, special agent-in-charge of IRS-Criminal Investigation's Newark Field Office, in a statement. "Today's indictment underscores our commitment to work in a collaborative effort to promote honest and ethical government at all levels and to prosecute those who allegedly violate the public's trust."

Taco Restaurant Owner Really Cooks the Books

Owner Rogelio Villasenor of the Tacos Michacan restaurant in Boise, Idaho, pleaded guilty to conspiracy to attempt to evade tax.

He failed to report $1,176,506 of income and was sentenced to 41 months in prison, 3 years supervised release, a $20,000 fine and ordered to pay a tax assessment of $329,421 to the IRS. But most of his unreported income was derived from illegally growing marijuana on public lands, as well as methamphetamine, marijuana and cocaine trafficking.

In addition to his penalty and prison sentence, he had to forfeit real property, bank accounts and a vehicle.

Prison for Under Reporting $15 Million of Income by $15 Million

Bradley T. McKouen, owner of Delta Staffing LLC in Detroit, Michigan was sentenced to 18 months in prison, 2 years supervised release and ordered to pay $319,000 in restitution. As the company was a Schedule C company, McKouen's profits should have been filed on Schedule C of his personal returns. In 2008, while his gross receipts were approximately $5.7 million, he reported $0 gross receipts, $0 business income, $0 taxable income and $0 income tax due. His actual taxable income was $299,000 and his tax due was $110,000. Under a plea agreement, he is also being held responsible for filing similar zero returns for 2004-2007, the total amount of unreported income of $15 million.

Prison and Fine for Exotic Dancer

Failing to report over $850,000 in income on her 2005-2008 tax returns, Veronica Fairchild of Sioux Falls, South Dakota was sentenced to 33 months in prison, ordered to pay the IRS over $214,000 in restitution and convicted of four counts of tax fraud. Fairchild claimed the unreported income she received from performing private shows as an exotic dancer was a gift.

Accounting Firm Owner Sentenced to Prison

Accountant Denise Swanson of Statesville, North Carolina gave new meaning to her company, "Bottom-Line Accounting". Between 2006 and 2012, Swanson performed tax preparation services for her clients and businesses, which also included receiving funds from clients to make tax payments on their behalf. Instead of paying the IRS, Swanson embezzled the money for her own personal expenses.

Not only was Swanson sentenced to 24 months in prison, 3 years of supervised release and ordered to pay restitution to her clients to the tune of $839,830, she was ordered by the IRS to pay back taxes of $249,912 for failing to report her embezzled income. Swanson had previously pleaded guilty to tax evasion for the year 2010.

You could say "Bottom-Line Accounting" hit rock bottom!