Achieve Tax Resolution with an Offer in Compromise

An offer in compromise is the IRS’ tax resolution debt settlement program. It’s a program for taxpayers who owe the Internal Revenue Service more money than they can afford to pay.

It’s the IRS’s version of a “fresh start” when it comes to tax debt. If approved, the IRS accepts a lesser amount (sometimes a fraction of what’s owed) to settle your debt. However, it isn't always easy to gain approval due to its strict criteria. Your odds for acceptance increase significantly when you have experience negotiating with the IRS.

The IRS considers your income, assets, expenses, ability to pay, and whether paying the full amount would cause financial hardship.

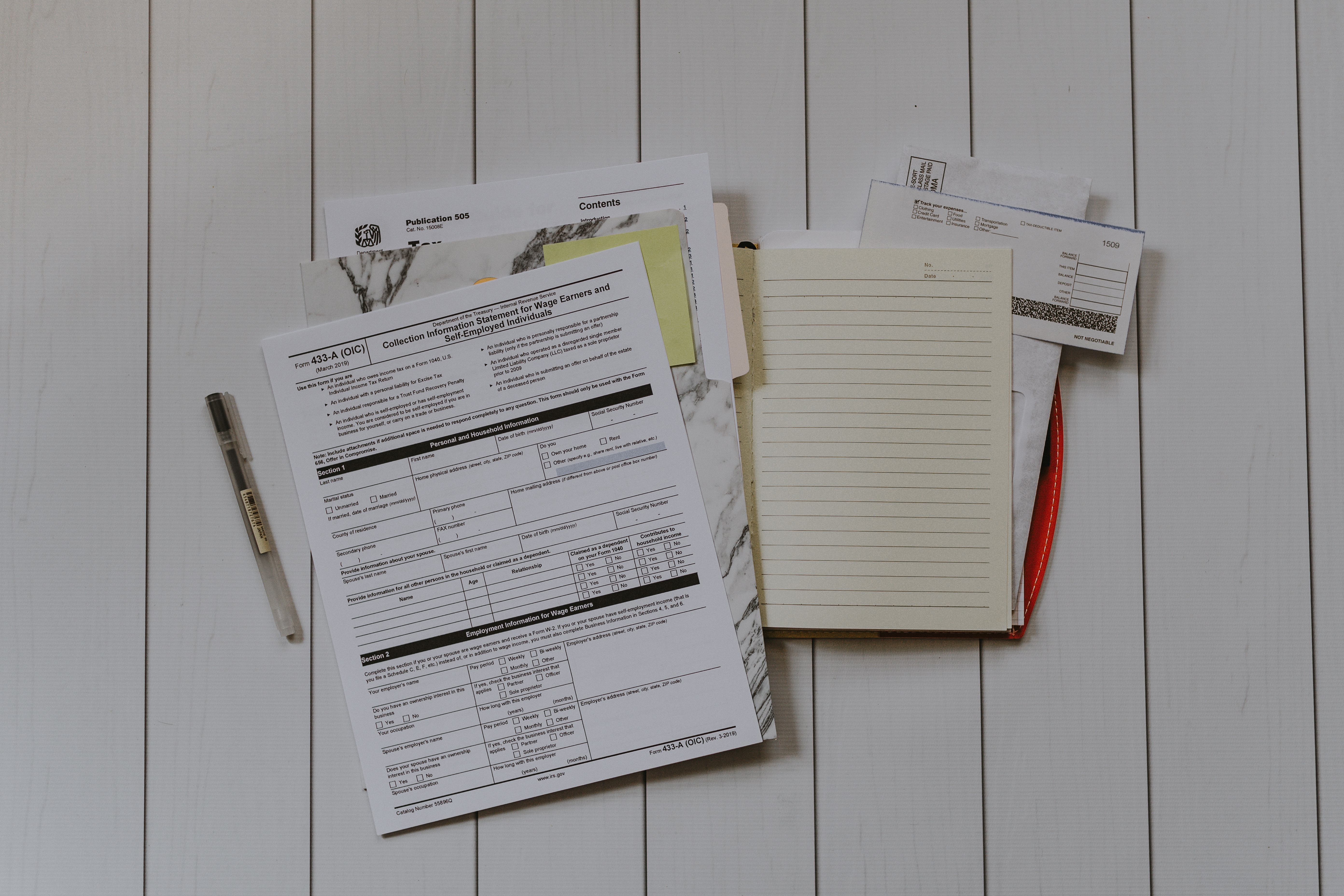

Information You Need to Submit an Application for an Offer in Compromise

It's important to remember that the IRS wants its money and will only accept an offer in compromise if it thinks it wouldn't receive any money otherwise. You must be current with all filing and payment requirements to apply. Additionally, you cannot be in the process of filing bankruptcy.

You can find more information about the IRS Offer in Compromise on the IRS website here. If you want help with your back tax problem, contact us today for a consultation. www.elitetaxrelief.com 479-242-7499.

After supplying the IRS with your name, address, social security number, and the amount of tax debt you would like it to consider for this program, you need to supply details about your income, assets, and expenses. In addition to wages, your personal income can include:

● Business profit

● Self-employment income

● Rental income

● Child support or alimony

● Interest on investments

Your assets can include things such as:

● Stocks and bonds

● Resale value of your personal vehicles

● Market value of your home

● Balance of your retirement savings accounts

● Balance of bank accounts, including checking, savings, and investments

For the expense section, you should only include items you pay regularly. These may include:

● Rent or mortgage

● Child support or alimony

● State and federal taxes

● Daycare costs

● Costs to maintain a vehicle

● Auto, health, and life insurance

Compiling this information and completing the application correctly can be challenging even for tax practitioners who don’t have expertise in dealing with the IRS. Your CPA or tax advisor most likely doesn’t have experience with resolving back tax issues. That’s why we recommend working with a specialized tax resolution professional like us to better understand this option and increase your chances of approval.

I’m In Tax Trouble, What Are My Options?

A letter from the IRS is rarely a good thing. One of the worst missives to get from the tax man is the CP90 – Final Notice Before Levy. It is a final warning shot to scare you into paying up and should not be ignored.

After an IRS final notice, you could:

- Pay in full - but if you could afford to do that, you probably already would have done so.

- Sign on for an installment agreement on your own, with penalties and interest so excessive it will never end.

- Ignore them and wait for terrible consequences like garnished wages and tax liens. Don’t do this, ever.

- Contact your tax resolution professional to see what your resolution options are.

The CP90 intends to intimidate you into calling so the IRS can take as much as possible from you even if it leaves you in dire financial straits, unable to pay your bills or support your family.

A better option is to work with a certified tax resolution expert that can negotiate on your behalf for better results. A tax expert can pursue resolutions that would be difficult (if not impossible) to negotiate on your own. Below is a look at four options to deal with tax debt.

Offer in Compromise (OIC)

An offer in compromise (OIC) is an agreement between a taxpayer and the Internal Revenue Service that settles a taxpayer's tax liabilities for less than the full amount owed. It can be far more reasonable than an IRS installment agreement, but you have to see if you qualify based on your unique financial situation and specific case.

Installment Agreement (IA) or Partial Payment Installment Agreement (PPIA)

These are well-structured installment agreements that can slash penalties by 50%. The IA is an agreement to pay what’s owed in full while a PPIA lets you pay a reduced amount. These agreements generally run 6-72 months,

Penalty Abatement (PA)

This agreement strips away penalties tacked onto your tax balance. Penalties include failure-to-file, failure-to-pay, and failure-to-deposit (for business owners). If you’ve never had a penalty before, a first-time abatement (FTA) penalty waiver may apply. Otherwise, your tax relief consultant can fight for a reasonable cause abatement if any of the following apply:

- Illness, death, or incapacitation of the taxpayer or their immediate family

- Fire, casualty, natural disaster, etc. affecting the taxpayer

- Inability to obtain records and documents

Currently Not Collectible (CNC)

In cases of extreme financial hardship, your tax rep can argue that you can’t afford to pay anything. With this option, your tax debt goes on the back burner, and you make no monthly payments although penalty and interest keep accruing. The big advantage of CNC is that the 10-year statute of limitations on collection keeps ticking so you might be able to ride it out and pay nothing on the tax debt. If you’ve received an IRS final notice or threatening letter, don’t ignore it. Instead, contact Elite Tax Relief at 479-242-7499 or 1-855-4-IRS-DEBT to speak with a tax resolution specialist to get the IRS off your back for good.

Do You Owe Back Taxes? Why You Should Stop Panicking and Start Planning

If you owe back taxes to the IRS, some amount of panic is understandable. After all, the Internal Revenue Service has the power of the federal government in its corner, something no other debt collector can claim. They are considered the most brutal collection agency on the planet. I used to not think so, but after having worked with them now for several years, I know this to be true.

It is easy to freeze up and just do nothing when you owe back taxes to the IRS, but hiding from, or doing nothing about your tax debt will not make it go away. In fact, ignoring the taxes you owe will only make the situation worse, since interest and penalties can really add up. You also risk having your paycheck garnished (the IRS does not need a court order to do this) or your bank account levied. The IRS can also file a Notice of Federal Tax Lien making it all but impossible to obtain financing for a car or home.

So instead of panicking about your tax debt and hoping the problem will go away, you need to take some proactive steps. Now is not the time to panic and hide - now is the time to start taking action.

Some of these steps you can do on your own if you’d like, while others will likely require the intervention of an experienced tax resolution expert. Here are some proactive steps you can take to get a handle on your tax debt. If you need help resolving your IRS tax problem, contact us here www.elitetaxrelief.com or call 479-242-7499 We help people with IRS problems every day.

Confirm the Amount Owed

When you owe back taxes, one of the first things you should do is make sure you really owe the money. The IRS has been known to make mistakes. A lot of mistakes. They are far from foolproof. Contact the IRS or have us do an IRS transcript analysis to determine the amount the IRS claims you owe, and where you are in the collection cycle, ie: whether levies are the next imminent step.

Seek Out Deductions You May Have Missed

At the very least, you may not owe as much as you think you do, and every dollar you can remove from the bill is one more dollar in your favor. Now is the time to scour your past and current tax returns, looking for deductions and tax credits you might have missed.

Unless you are a seasoned tax expert, you will probably need some professional assistance to make this happen. If you are already working with a CPA or tax expert, you can ask them to look at your past tax returns but only a tax resolution expert, who helps people like you for a living, can protect your income and assets as you go through the process.

If you missed a few deductions and tax credits along the way, your tax professional can file amended returns on your behalf, lowering the amount of tax debt you owe - and possibly eliminating it altogether. However, you usually can’t go back more than 3 years to amend returns.

Look for Special Programs You May Qualify For

The bad news is the IRS wants its money and has the power to collect it.

The good news is the tax agency also offers several programs tax filers can use to make the repayment process easier. In some cases, the IRS may even be willing to settle for less, possibly much less, than the total amount of back taxes you owe.

These programs are not available to everyone, and if you have the resources needed to pay your back taxes, the IRS is unlikely to give you much of a break. But if your resources are limited, the tax agency may decide that a small amount of tax repayment is better than none at all.

The first step in the process is finding the programs for which you might qualify, and that will probably require the help of an experienced tax resolution expert. Most CPAs do not have this experience. Negotiating with the IRS is not an easy thing to do, and you may need help to drive the best bargain and reduce your back taxes. In the end, it may be well worth paying a tax relief expert to negotiate on your behalf, especially if you end up with a much lower tax bill.

It is easy to panic when you owe back taxes, but you should not let fear get in your way. The longer you ignore the problem, the worse it is likely to get, and the sooner you act, the better off you, and our finances, will be. There is a solution to every IRS problem. Let us see what IRS tax debt settlement programs you qualify for today.

Dear Truck Drivers

Are you a truck driver with tax problems? Maybe you didn't keep updated mileage and expense logs? Maybe you didn't set anything aside for your 1099 tax debt? Or you just have questions regarding compliance . Here at Elite Tax Relief we help lots of truck drivers get in to tax compliance.

Check out our video about truck driver tax issues

https://www.youtube.com/watch?v=ZaNqmuw7gB8

Tax Organizers for Everyone

Are you coming in to Elite Tax Relief to do your taxes?? If so here are some handy tax organizers that will help you get prepared and ensure that you have all necessary paperwork and information.

Small Business Health Care Tax Credit

Mileage and Expense Log Organizer

Rental Property Income Tax Organizer

Gambling Winnings/Losses Organizer

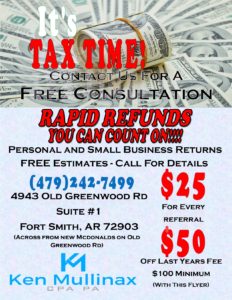

It's TAX Season

Tax season is upon us once again. For some that means a huge headache and worry. Others look forward to that big refund check. Whether you need professional tax assistance for IRS problems or want to make sure you get the biggest return possible, swing on in and let us help you. Our tax professionals are here to assist!!!

If you need a tax organizer for your documents to help you get ready, let us know in the email section and we will make we get one to you either via email, post office mail or fax, also going to include them for download in the next blog post

Fort Smith, Arkansas Tax Resolution Expert

Kenneth (Ken) Mullinax is a Fort Smith, Arkansas-based tax professional expert serving individuals and businesses throughout the United States. For six years, Ken worked for the IRS, enforcing tax laws and bringing taxpayers into filing and payment compliance. The more Ken worked with taxpayers, the more he knew his passion was not working for the IRS, but rather working for the troubled taxpayers in Arkansas and other states so they could have expert advice and advocacy to find relief and resolve their current tax problems. Ken left the IRS to lead Elite Tax Relief LLC. He’s never looked back.

Working for the IRS provided Ken with an edge and a unique set of skills that is not possessed by most CPAs or tax resolution professionals.

He is uniquely qualified to handle IRS resolution cases. Ken is a Certified Public Accountant and an Enrolled Agent – licensed in the State of Arkansas. He is also a member of the Arkansas Society of CPAs and the American Society of Tax Problem Solvers (ASTPS).

For this tax resolution expert, his passion (helping families, individuals and businesses find tax debt relief) is his profession.

Follow Ken on Twitter for expert tax tips and news. You can also connect with him on his personal LinkedIn page and on Facebook or subscribe to his blog.

What is a Substitute for Return (SFR)?

If you haven't filed tax returns in several years, maybe because you didn't think you had to or maybe out of procrastination, or for a lot of folks, due to hardship, yet you are getting tax bills for some crazy amount you couldn't possibly owe, then the IRS has filed those returns for you.

This is called an SFR, Substitute for Return.

The SFR lists income, calculates taxes, and adds interest and penalties for failing to file your taxes. According to the IRS, “this return might not give you credit for deductions and exemptions you may be entitled to receive.” Although it might seem like a relief for some procrastinators who never filed their taxes, it might come at a very expensive price.

If you have questions about your SFRs, contact us to help. Working on Substitute for Returns is one of the scenarios we handle every day. We are located in Fort Smith, Arkansas and handle cases throughout the United States.

Give our tax resolution professionals a call at (855)-447-7332. We offer a free consultation to review your IRS troubles, and explain your solutions.

Fort Smith, Arkansas Tax Debt Professionals

Do you owe the IRS $15,0000 thousand dollars or more? Have you searched for help only to find it's coming from out of state? I'm Ken Mullinax founder of EliteTaxRelief.com. I'm located in Fort Smith, Arkansas and I specialize in helping people resolve their tax problems. As a former IRS revenue officer, I know their collection tactics and can help you avoid their pitfalls. Don't risk the IRS taking your money right before Christmas.

Call us at (855)-447-7332 to schedule a complimentary tax resolution consultation where we will review your tax debt and explain your options.

Get Expert IRS Representation from the Get-go!

We’ve been losing sleep over a new tax resolution client’s situation. This couple owes $43,000 to the IRS. They are penniless and living in a camper trailer behind a benevolent friend’s house. He is on social security (SSA) at $830 per month. She is unemployed.

They had an Arkansas business that went defunct. And when it did, they cashed out all of their retirement funds and gave it to the IRS, and were left with the $43,000 balance. This they did on the advice of a CPA they trusted. Then the couple got a FPLP levy on the SSA so they hired a tax relief company in California that they saw on a late night commercial. These guys have been hitting them for $150 per month since February, and haven't gotten the levy removed. They also advised her to not get a job; terrible advice from all sides.

Our Arkansas tax resolution experts have been meeting with them and are working hard to bring resolution to their case. We can’t wait to bring peace back into their lives.

What a difference it would have made for them to get competent representation

at the beginning.

IRS representation is not an easy task. It takes extensive experience, diligence, and a passion for the tax resolution field. Before hiring a tax resolution professional, we encourage you to ask them these questions:

- In addition to being a Certified Public Accountant (CPA) and/or an Enrolled Agent (EA), do you have SPECIFIC experience in tax problem resolution/IRS representation?

- Are you a member of the American Society of Tax Problem Solvers (ASTPS)?

- What is your success record as a tax resolution professional?

Getting the right IRS representation from the beginning is important. Contact our Arkansas tax debt experts if you’ve found yourself in an ugly tax situation.

We offer a free consultation to discuss your options, and will answer your tax-related questions.

We help individuals, families, and businesses nationwide.