When DIY Won't Do: 3 Times, When Hiring a Tax Relief Professional is the Only Way to Go

When it comes to your money, there’s only one person that truly has your best interests at heart - and that person is looking back at you in the mirror. Handling your own finances and making your own decisions can give you peace of mind and help you avoid a costly mistake.

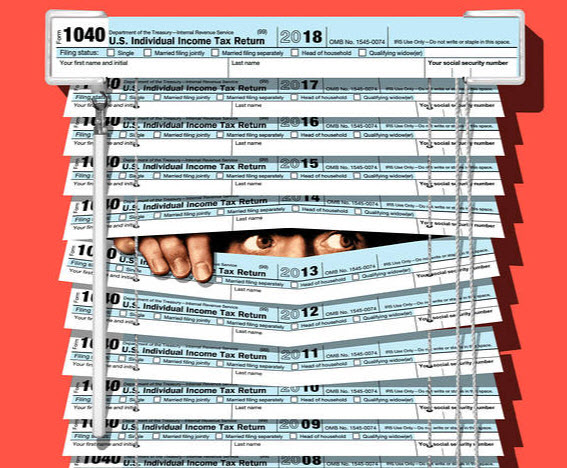

There is a lot to be said for the do-it-yourself approach to your money, yet the go it alone path does have its limitations, especially when it comes to the IRS and back taxes.

We see clients that have tried to handle their taxes on their own, sometimes raising red flags with the IRS, resulting in audits, or getting hit with a big tax bill they can’t pay. They might setup an installment agreement on their own, but often times, the DIY approach just makes the penalties and interest keep stacking up putting in an endless loop of back taxes. Many of our clients started out by trying to do this on their own or with their current tax preparer.

Dealing with the IRS takes a very specialized skill set that most tax preparers and even CPA’s don’t possess. Make sure you have a tax resolution specialist on your side. Rarely can someone who is not a tax resolution specialist achieve the same results as someone who works in this field.

So, before you end up in that horror story, here are 3 times when hiring a tax pro or a tax relief firm like ours is the only way to go.

#1 You Just Received a Major Windfall

Even if you know how to handle your finances, receiving a major windfall can throw your plans for a loop. Whether you are the lucky holder of a winning lottery ticket or the recipient of a major inheritance, it pays to seek outside advice.

If you choose the DIY approach and make a mistake, you could end up paying more in taxes than you should, but a high tax bill is not the only danger. Handling your windfall the wrong way could throw off your asset allocation, impact financial aid for your college-bound children and create additional problems down the road.

#2 You Have Existing Tax Problems with the IRS

When you have issues with the IRS, you absolutely cannot afford to go it alone. Attempting to resolve tax issues on your own is unwise in the extreme, and a single slipup could leave you on the hook for even more. I mean, ask yourself if you would go before a judge in court without a lawyer representing you? Probably not. It’s the same here. Representing yourself before the IRS is generally not a good idea. Don’t do it. You most likely will get “creamed”!

If you receive a notice from the IRS, time is of the essence, but you should not let the desire for fast action override the need for professional help and guidance. If you want to resolve your issues fairly without going broke, do yourself a favor and find the right tax resolution firm. Hiring an enrolled agent, CPA or an attorney who is trained in tax relief is the best way to preserve your rights. You do not want to go it alone.

#3 When You Have Assets You Need to Protect

When you owe taxes, the IRS only cares about one thing, and that is to get paid what they think you owe them.

They’ll levy your bank account, emptying everything you have in there. If you run a business, that means you won't be able to pay your employees, pay your office rent or keep your lights on, ultimately putting you out of business.

They’ll also garnish your paycheck leaving you about 10% to 25% of your net pay to live on. Good luck with that.

They can also put a lien on your assets, including real estate, personal property and financial assets. This puts in jeopardy everything you’ve worked so hard to attain.

Hiring the right tax relief professional can help you avoid such extreme measures taken by the IRS. They’ll communicate with the IRS on your behalf and can often remove a lien or levy. If you have assets you can’t afford to lose, then hiring a tax relief pro is the only way to go.

The Bottom Line

Even if you are confident in your DIY approach or feel your tax problem isn’t so serious, it never hurts to get a second opinion. If you are doing everything right, that tax resolution specialist’s advice will give you peace of mind. If there are deficiencies in your actions, the advice you get could stop you from making a devastating, and possibly irreversible, mistake.

If you do run into tax trouble, reach out to our tax resolution firm and we’ll schedule a free, no-obligation confidential consultation to explain your options in full to permanently resolve your tax problem. Visit us at www.elitetaxrelief.com or CALL NOW! (479) 242-7499.

What is Currently Not Collectible Status from The IRS?

Big companies are known for getting all sorts of breaks, but when average people fall behind, they rarely receive help. When you owe back taxes, but can’t afford to pay them, then you may qualify for a special tax status known as currently not collectable.

If you’re approved for currently not collectable status, then the IRS must not only cease its collection efforts but can no longer garnish your wages or seize your property.

Want to know if you qualify for currently not collectable status? Contact our firm here for a specific evaluation of your situation. Call (479) 242-7499.

What is Currently Not Collectible Status?

If the IRS agrees you can’t both pay your back taxes and cover your reasonable living expenses, it may place your account in Currently Not Collectible status. It’s based on your current financial situation.

You can request currently not collectible status by submitting the proper form and proof to the IRS of your income and expenses, as well as whether you can sell any assets you may have or get a loan.

As you’ll need to be able to document your inability to pay, be sure to gather copies of all your bills, your most recent paycheck stubs, and statements detailing other sources of income such as alimony, pensions or investments. If the IRS determines that your necessary expenses exceed your income, then it will notify you of your Currently Not Collectable status

WARNING: Don’t try to do this alone. We recommend reaching out to our tax resolution firm to guide you through your options. Talking to the IRS directly could be like shooting yourself in the foot. They’ll ask you very invasive questions that could land you in deeper trouble. Remember, the IRS is not your friend. Their job is to collect what they believe you owe them, so it’s best to have a professional in your corner.

Not a Permanent Solution

Keep in mind that currently not collectible status applies only to your back taxes. You will still have to file tax returns, and you will not be exempted from paying current and future taxes. You will also continue to accumulate penalties and interest on your unpaid taxes. After a year or two, the IRS may review your status, and if you’re able to begin paying your back taxes, then you must do so. If you’re still not able to pay, then your status will be renewed.

Statute of Limitations

The IRS can attempt to collect outstanding taxes for only 10 years from the date the taxes were assessed against you, usually, that’s the date you filed. If at the end of this 10-year period the IRS hasn’t collected, then the taxes are no longer owed.

In difficult times, many families have trouble meeting their commitments. If you’re worried about the IRS garnishing your wages, levying your bank account or taking your home, then reaching out to our firm and getting a free, no-obligation, confidential consultation on your tax problem may give you some peace of mind. If you’re not approved for Currently Not Collectible status, our firm will discuss the many other tax relief options with you. Contact us now at www.elitetaxrelief.com or (479) 242-7499.

4 Mistakes That You Don't Want to Make When Filing Your Taxes. (They Could Land You In Tax Trouble)

It can be a stressful experience preparing your taxes and filing them. It can be even more stressful however, if you make these mistakes that land you into tax trouble. It's important to remember that if you make mistakes that are serious enough, you might end up triggering an audit of your tax return or owe more in back taxes.

It’s early to be talking about tax season, but if you're planning on filing your own taxes this year, here are four mistakes that you should avoid.

Don't neglect to report all your income

Whatever your sources of income may be, whether it's your regular paycheck, a side gig, gains that you've made on the stock market, or interest that you've earned from deposits in the bank, it's important to remember that you should account for all of it in your tax return. If you don't, the IRS may come looking for it.

Every time you make at least $600 in income working as an employee of any description, you’ll get a 1099 form stating what you've made. The IRS gets a copy of the form, as well. This means that it makes no sense to try to hide your income from the IRS.

When you make any kind of income, you should report it on your tax return. Technically, you should even record smaller chunks of income, the kind for which you don't get 1099 forms.

Don't just guess at what your deductions are

There are many possible tax deductions that you could take advantage of. It's important to remember, however, that you do need to back up every attempt at a deduction with documentary proof like receipts or logs. If you attempt a rough estimate at what your deductions should be, you could trigger suspicion, especially if the sum that you claim is high for your income level, or if it is a convenient round figure.

Don't automatically reject the idea of itemizing

Most tax filers choose to take the standard deduction, rather than itemize. This doesn't mean that you shouldn't itemize. It depends on your specific circumstances. If you have many legitimate deductions to make, say, because, you pay a great deal of mortgage interest, you might be better off itemizing, even if it takes more work to do it.

Don't put off filing

Preparing your taxes is a complex process. If you're self-employed, or if you need to itemize, it can only get worse. It's important to not rush through the process. Any mistakes that you make may prove costly. Take out the time to file your taxes well ahead of the tax deadline. If you need extra time, you can always file for an extension. This way, you can avoid the late filing penalty, which can add up to a whopping 25% of the original tax amount

Making a mistake on your tax return is the last thing you want to do. Mistakes can be complicated to correct and recover from. It's important to give yourself enough time.

Whatever you do, don’t skip filing. Many clients come to us with not only years of unfiled tax returns but owing large sums of money to the IRS. Many times we can help you obtain a “fresh start’ settlement for up to 85% (or more) off the original amount owed, including penalties and interest, if you qualify.

If you do run into tax trouble, reach out to our tax resolution firm and we’ll schedule a free, no-obligation confidential consultation to explain your options in full to permanently resolve your tax problem. Visit us at www.elitetaxrelief.com or call (479) 242-7499.

8 Reasons to Work with a Tax Resolution Professional To Resolve Your Back Taxes

When you owe money to the IRS, it is hard to think about anything else. While being in debt is never fun, no matter who the creditor is, the IRS enjoys almost unlimited power to collect the money they are due.

Unlike your mortgage lender or credit card company, the Internal Revenue Service has the power to attach your wages, raid your bank account and even take your freedom. No other creditor even comes close in terms of its power and influence and taking on the agency on your own could be asking for trouble.

If you have received a notice from the IRS, you need to act fast, and you need the right assistance in your corner. Taking on the IRS requires specific expertise, and that is why it is so important to work with a quality tax resolution company. Here are eight reasons why working with a tax resolution service could save your good name - and your bank account.

- You gain specific expertise. The IRS is a specialized agency, and you need expert advice and guidance to get the most positive resolution.

- It will give you peace of mind. Just being contacted by the IRS can make your heart beat a bit faster, but working with a tax resolution expert can set your mind at ease. Generally, once you hire a tax resolution expert you won’t have to meet or speak with the IRS.

- The tax resolution process could save you a lot of money. Tax resolution agents are experts at settlements, and working with one could save you a ton of money.

- Timely action could save your home and property. If you wait too long, you could put your home, business, bank accounts and personal property at risk. Time is of the essence when it comes to resolving tax issues, and timely assistance could make a world of difference.

- You will feel less alone. Few things feel as lonely as fighting the IRS on your own. When you work with a tax resolution expert, not only do you not have to go it alone but they actually step into your shoes to represent your best interests.

- You will have a chance to file missing returns. When faced with a big tax bill, it is easy to do nothing, but failing to file tax returns could have serious consequences down the line. If you have years of unfiled returns, a tax resolution expert can help you catch up.

- Expert help could make an audit less scary. Receiving that audit notice in the mail can be frightening, but a tax resolution expert can guide you through the process. When you work with a tax resolution professional, you will have one less thing to worry about.

- You could save your credit score. Unresolved issues with the IRS will reflect badly on your credit report, lowering your credit score and making it harder to borrow money or qualify for a mortgage. Timely tax resolution could preserve your stellar credit score and help you avoid those serious consequences.

Owing money to the IRS can be very frightening. There is a reason those three letters strike so much fear into the hearts of ordinary citizens, even those who have done nothing wrong.

If you are in trouble with the IRS, you cannot afford to ignore the issue, so act fast and get the help you need today. Working with a tax resolution expert carries a host of benefits, starting with the eight outlined above.

Reach out to our firm and we’ll schedule a no-obligation confidential consultation to explain your options in full to permanently resolve your tax problem. Visit us at www.elitetaxrelief.com or call (479) 242-7499 Now!